Strategies to Improve Own Source Revenue Collection in Morogoro Municipal Council – Tanzania

- 2025-10-06 (2)

- 2025-06-21 (1)

Versions

- 2025-10-06 (2)

- 2025-06-21 (1)

Downloads

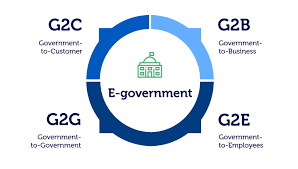

The Local government Finance Act 1982 empowers local government authorities to set fees and charges to offset the costs of their services, thereby enhancing service delivery. One of the strategies was the adoption of point-of-sale (PoS) machines for revenue collection aimed at reducing corruption and embezzlement of funds. Despite this inventiveness, revenue collection was not improved. This leads to the underperformance of local government authorities. Therefore, the study examined strategies for improving own source revenue collection at Morogoro Municipal Council. The study was guided by two specific research objectives: to describe potential revenue sources within the Morogoro Municipal Council and to identify the regulatory frameworks governing revenue collection within the Morogoro Municipal Council. Theoretical concepts from political economy were employed to guide the study. A sample of 85 respondents was selected through a combination of purposive and convenience sampling techniques to collect data via questionnaires, interviews, and document reviews. Descriptive analysis and content analysis were used to analyse the collected data. The study revealed that close supervision, lobbying and advocacy, training and education programs, strict compliance with legal frameworks, outsourcing revenue collection, the application of technological development activities, and timely salary and allowances are relevant strategies used to improve own-source revenues in the Morogoro Municipal Council. The study has demonstrated that a combination of strategic approaches is essential for enhancing own-source revenue collection in the Morogoro Municipal Council. Close supervision ensures accountability and reduces revenue leakages, while lobbying and advocacy create an environment that enables revenue mobilisation. Own-source revenues are crucial for the effectiveness and efficiency of local government authorities, particularly in delivering services to the community. Therefore, there is a need for the council to establish regular monitoring and evaluation systems to ensure continuous oversight of revenue collection activities, thereby facilitating efficient revenue generation.